Dogecoin has long been a retail phenomenon. Its community thrives on prediction charts, celebrity endorsements, and social media cycles that swing the token’s price from one extreme to another. Forecasts flood the market, but most of them rely more on sentiment than fundamentals.

Recent developments have sharpened the picture. A new US Dogecoin ETF, DOJE (Rex-Osprey), began trading and recorded around $6 million in volume during its first hour. At the same time, Elon Musk’s lawyer Alex Spiro announced a $200 million Dogecoin Digital Asset Treasury (DAT) designed to hold DOGE as a long-term reserve. These moves suggest a gradual transition from meme-driven speculation toward regulated exposure and treasury-style vehicles. Yet even with these steps, Dogecoin’s valuation still leans heavily on market momentum rather than structured mechanics.

Smart investors, however, rarely chase meme-driven volatility. Instead, they search for opportunities with transparent mechanics, predictable valuations, and independent verification. XRP Tundra has emerged as one such project, offering a dual-token presale with confirmed launch pricing, staking rewards for XRP holders, and a security-first approach that has already passed multiple audits.

Dogecoin’s Price Prediction Obsession

Dogecoin’s popularity remains rooted in its culture. Chartists and retail traders treat it as a speculation playground, with predictions circulating across forums and social media platforms. The excitement is undeniable, but fundamentals remain thin. Dogecoin has limited utility beyond payment functions, and most trading depends on community enthusiasm rather than protocol-driven value.

ETF and DAT initiatives give Dogecoin a new layer of legitimacy, yet they do not change its reliance on market sentiment. For institutional players, exposure through these instruments may make sense, but for long-term strategy, many still see Dogecoin as volatile compared to projects that offer clear utility and defined tokenomics.

XRP Tundra’s Measured Approach

In contrast, XRP Tundra offers a presale built on defined numbers. The system issues two tokens: TUNDRA-S on Solana, which powers utility and yield flows, and TUNDRA-X on the XRP Ledger, which secures governance and reserves. Every buyer of TUNDRA-S automatically receives free TUNDRA-X, giving exposure to both sides of the ecosystem.

During the current Phase 2 presale, investors can purchase TUNDRA-S for $0.02, gain an 18% token bonus, and receive free TUNDRA-X worth $0.01. The allocation is significant, with 40% of TUNDRA-S supply reserved for presale distribution. Importantly, XRP Tundra has already set its launch targets: $2.50 for TUNDRA-S and $1.25 for TUNDRA-X. These figures provide a reference point for participants long before market listing, replacing speculation with defined benchmarks.

From Meme Cycles to Predictable Yield

Where Dogecoin relies on community energy, XRP Tundra seeks to create lasting utility through yield. Its Cryo Vaultsallow XRP holders to stake tokens for 7, 30, 60, or 90 days, with yields scaling up to 30% APY for longer commitments. Unlike many DeFi protocols that rely on lending pools, these vaults keep assets secured directly on-ledger.

Additional flexibility arrives through Frost Keys, NFTs that can boost multipliers or shorten lock-up terms. Together, the system offers staking that is both transparent and customizable. While staking is not yet live, presale buyers secure first access once the feature activates. This approach appeals to investors seeking yield strategies grounded in clear mechanics rather than speculative meme cycles.

Independent channels have also begun dissecting the model. Coverage such as Crypto Legends’ review highlights how XRP Tundra delivers features that differ fundamentally from hype-driven assets.

Independent Reviews Strengthen Investor Confidence

Another distinction lies in oversight. Dogecoin’s culture thrives on volatility, while XRP Tundra emphasizes accountability. The project has already completed independent audits with Cyberscope, Solidproof, and Freshcoins. These reviews confirm contract functionality and mitigate risks often associated with presales.

In addition, the team behind XRP Tundra has undergone Vital Block’s KYC verification, making leadership accountable and further differentiating the project from anonymous launches. For institutional investors and experienced builders, these steps carry weight, signaling an effort to align with the standards that serious capital demands.

A Strategic Shift for XRP Holders

For XRP holders, XRP Tundra represents more than another token sale. It provides long-awaited staking mechanics, a dual-token framework that separates utility from governance, and confirmed launch valuations that remove ambiguity. Knowing in advance that TUNDRA-S will list at $2.50 and TUNDRA-X at $1.25 allows investors to assess their entry point with precision.

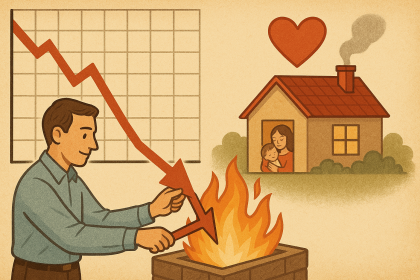

The contrast with Dogecoin could not be clearer. Meme-driven prediction charts may offer entertainment, and new ETF and DAT products add legitimacy, but they do not change the reliance on volatility. XRP Tundra builds its value proposition on verifiable mechanics and transparent economics. This explains why “smart money” has zagged toward its presale while much of the retail crowd remains focused on Dogecoin’s charts.

Secure your spot in the presale and follow official updates:

Website: https://www.xrptundra.com/

Medium: https://medium.com/@xrptundra

Telegram: https://t.me/xrptundra

X: https://x.com/Xrptundra

Contact: Tim Fénix, contact@xrptundra.com