When credit cards, loans, and bills start piling up, debt relief companies begin to look like the only light at the end of the tunnel. Among the best-known in the United States is Pacific Debt Relief, a firm that claims to help people pay off their debt faster by negotiating directly with creditors.

The concept sounds simple: let someone else handle your debt stress while you make a single manageable payment. But before signing up, it’s crucial to understand what this program actually does, how much it costs, and whether it’s a safer option than payday lenders such as check n go.

How Pacific Debt Relief Works

Pacific Debt Relief is a debt settlement company, not a bank or loan provider. It doesn’t lend you money or refinance your accounts. Instead, it works to persuade your creditors to accept less than you owe — ideally allowing you to pay off balances for a fraction of the original total.

When you enroll, you stop paying your credit cards or personal loans directly. Instead, you make monthly deposits into a special account managed by Pacific Debt Relief. Once enough money builds up, they start negotiating settlements one creditor at a time. If the company reaches an agreement, you approve the payment, and that account is officially closed.

The idea is that creditors prefer to recover something rather than risk getting nothing if you file for bankruptcy. The process usually lasts two to four years, depending on how much debt you have and how quickly you can fund the account.

The Benefits People Hope For

Debt settlement offers a few genuine advantages for those buried in unsecured debt:

- You may end up paying 40–60% less than the total balance.

- You only deal with one monthly payment instead of several.

- You no longer have to face aggressive collection calls once settlements begin.

- You can avoid bankruptcy, which has more severe long-term consequences.

For people who have already fallen behind on payments and see no path forward, working with a company like Pacific Debt Relief can feel like finally having a plan instead of chaos.

The Risks You Need to Know

For all its potential benefits, debt settlement carries serious trade-offs. The first is credit damage. Because you stop paying your creditors, your credit score will almost certainly plummet. Each account you stop paying will be marked delinquent, and those negative marks can remain on your credit report for up to seven years.

The second risk is cost. Pacific Debt Relief charges fees that typically range from 15% to 25% of your total enrolled debt. If you sign up with $30,000 in balances, you could pay between $4,500 and $7,500 in fees by the end of the program.

Finally, there’s the tax factor. The IRS may consider forgiven debt as taxable income. If you settle a $10,000 credit card for $6,000, that $4,000 difference might show up on your next tax return.

Is Pacific Debt Relief Legitimate?

Yes. Pacific Debt Relief has operated since 2002, maintains an A+ rating with the Better Business Bureau, and is accredited in multiple states. Thousands of clients have completed its program successfully.

However, legitimacy doesn’t guarantee it’s the right choice for everyone. Some clients report strong results and professional service, while others complain about slow communication or confusion around fees. Debt settlement outcomes depend on consistency — you must keep depositing money — and on how cooperative your creditors are.

What It Feels Like to Be in the Program

Enrolling in Pacific Debt Relief often brings immediate emotional relief. For many clients, the scariest part of debt is not knowing what to do next. Having a company step in to take over negotiations provides structure and clarity.

Still, the first six months can be stressful. Creditors continue to call, late fees pile up, and your credit score begins to drop. Settlements usually start after you’ve saved several months’ worth of deposits, so patience is essential.

When the first account finally settles, you begin to see progress — but staying consistent for the full term of the program is what determines success.

Who Should Consider It

Pacific Debt Relief can be helpful if you:

- Have at least $10,000 in unsecured debt such as credit cards or medical bills.

- Are already falling behind on payments.

- Have steady income and can afford monthly deposits.

- Want to avoid bankruptcy but can’t qualify for consolidation loans.

It’s designed for people in genuine hardship, not those looking for quick credit fixes.

Who Should Avoid It

You should avoid debt settlement if most of your debt is secured by assets like a car or home. Creditors holding collateral rarely agree to settle because they can seize the asset instead.

It’s also not ideal if you plan to apply for new credit or a mortgage soon. The drop in your credit score could make borrowing nearly impossible for several years.

Finally, you should think twice if your total debt is small. In those cases, the fees might cancel out much of the savings.

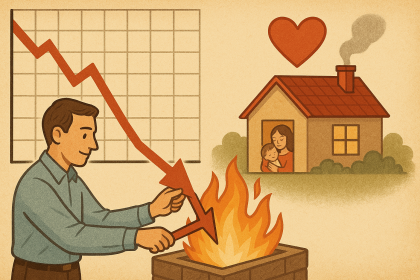

Debt Settlement vs Payday Loans

To see what makes settlement unique, it helps to compare it with short-term lenders like Check n Go.

Check n Go offers quick cash advances, often targeting people in financial emergencies. The catch is interest: payday loans can carry annual percentage rates (APR) above 300%. Borrowers often repay more in fees than they originally borrowed, leading to a cycle of dependency.

By contrast, Pacific Debt Relief doesn’t lend money at all — it tries to reduce what you owe. While settlement temporarily damages your credit, payday loans can trap you in even deeper debt.

The comparison highlights an important truth: when you’re desperate for financial help, fast money is usually the most dangerous kind. Programs that reduce debt take time, but they aim to close the hole instead of digging it deeper.

How Long It Takes to Recover

Most Pacific Debt Relief programs run between 24 and 48 months. Once you finish, the immediate goal should be rebuilding credit. Start by checking your credit reports to confirm that each account shows “settled.” Then open a small secured credit card and pay it off in full each month.

Within two years of your last settlement, you can often raise your score from poor to fair — sometimes higher if you manage new credit responsibly.

In the meantime, avoid taking on new loans or using payday services like Check n Go. Each new short-term loan adds more risk and interest at the very moment you’re trying to rebuild.

Common Misconceptions

Many people believe debt settlement instantly wipes their credit clean. It doesn’t. Even after your debts are settled, the record of non-payment remains. Others think creditors are required to negotiate. They aren’t — each company decides whether to participate.

Another misconception is that you can stop worrying once you enroll. In reality, you must stay involved. Confirm each settlement, track your balances, and ensure Pacific Debt Relief applies your funds properly. Active participation prevents delays and misunderstandings.

The Psychological Side of Debt

Money problems are as emotional as they are financial. Anxiety, shame, and hopelessness can cloud every decision. Working with Pacific Debt Relief can reduce that pressure simply because it introduces structure and accountability.

However, that relief can tempt people to disengage completely. The best results come when you treat the program as teamwork — Pacific handles negotiations, but you stay responsible for communication and consistency.

Rebuilding Financial Stability

When your final settlement is complete, you’ll feel a sense of liberation. But staying debt-free takes strategy. Begin with an emergency fund, even if it’s just a few hundred dollars. Having cash for unexpected expenses prevents future reliance on high-interest credit.

Then, focus on budgeting realistically. Track income and spending to see where the problem began. Finally, commit to using credit wisely: small purchases paid off immediately. Over time, this approach replaces the chaos that led to debt in the first place.

When Debt Settlement Makes Sense

Pacific Debt Relief makes the most sense for people who have already tried everything else — balance transfers, consolidation loans, and payment negotiations — and still can’t make headway. It’s for those whose debt feels impossible to manage but who aren’t ready to declare bankruptcy.

It’s not easy, and it’s not quick, but for the right person, it can be a bridge back to financial health.

Final Thoughts

Debt relief can be the difference between years of financial paralysis and a structured path forward. pacific debt relief is a legitimate company that helps thousands of Americans reduce unsecured debt each year. But it comes with sacrifices — lower credit scores, long timelines, and potentially high fees.

Compared to predatory payday lenders like check n go, settlement programs at least aim to solve the problem rather than prolong it. The process demands patience and discipline, yet for those who follow through, it can truly mark the beginning of a debt-free life.

The key is to enter the program with clear expectations and a plan for rebuilding afterward. Debt relief isn’t an escape hatch; it’s a gradual climb out of a deep hole — one that rewards commitment more than desperation.