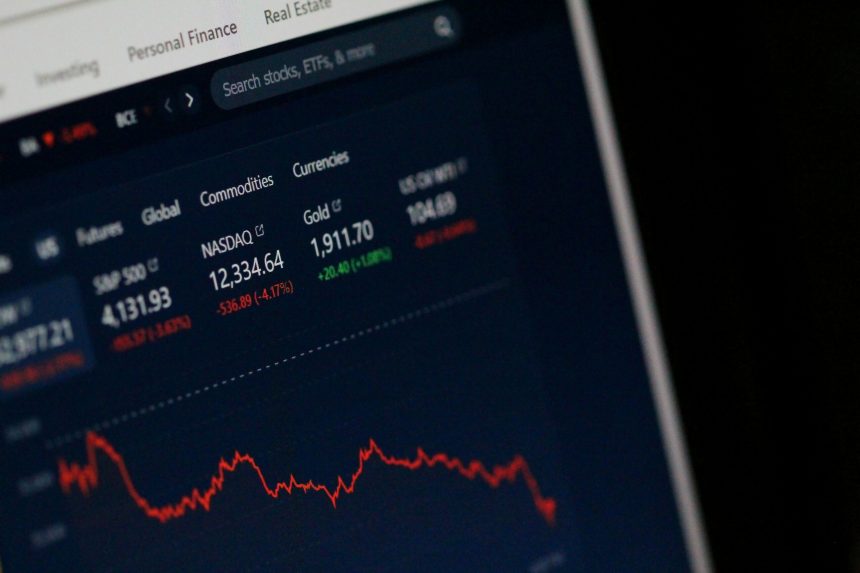

There’s no question that the recent market volatility, including the trillions lost in the stock market recently on the release of President Trump’s retaliatory tariffs, is difficult to stomach.

The Dow Jones Industrial Average fell almost 4%, the NASDAQ shed nearly 6%, and the S&P 500 index fell almost 5%.

In a sea of red, the natural inclination is to take action. Our lizard brains tell us it’s fight or flight, not fight or flight or sit and get eaten by a lion.

But in most cases, it’s not what you should do. We don’t abandon ship amid heavy swells. We stay the course, follow our investment plan, and avoid reacting emotionally.

But that’s easier said than done. Here are seven ways to avoid panicking in a volatile market.

1. Review Your Investment Plan

When you started investing, you had a plan that included your goals. Let’s look at a small piece of the plan – your retirement.

At its most basic level, your plan included when to retire, how much you wanted to contribute each month, and basic milestones you hoped to achieve.

A single bad day, or bad month, will not change your plan. Look back to how your portfolio has performed over the last year – the S&P 500% is up almost 5% even having fallen almost as much in a single day.

Use your part performance as a way to help you remain calm and understand this is all according to plan. Short term volatility shouldn’t derail your long term goals.

2. Reframe It as an Opportunity

If you are a long-term investor, reframe this time as not a falling stock market but a big sale on companies that didn’t suddenly change in the last 24 hours. Many have, if the tariffs remain as announced, but we know how quickly tariffs can be changed.

Unlike economic conditions, which have a litany of inputs and can’t be easily changed, just like the Federal Reserve. If tariffs are removed or reduced, as we saw just a few weeks ago, the market can jump up as quickly.

3. Stop Watching the News

Our minds are heavily influenced by what we consume. If you consume a lot of doom and gloom news, it’ll affect your outlook.

And if you check your portfolio often, which, after the last few days, is akin to doom and gloom news, you’ll start to panic. It’s difficult to watch your account balances go down. You’ll be pulled to take action. It’s like watching a thief walk into your house and walk out with your TV.

But don’t try to stop him. If it’s the stock market, he’ll be back… and maybe bring a better one with him.

4. Control What You Can

You can’t control the market, but you can control how much you spend and save. If you view the stock market as being on sale, by saving more and investing more, you get the same stock market but at a heavy discount.

Doing this also takes control of the situation and gives your fight-or-flight instinct something productive to do. Use it to find ways to save more money to either invest in the market or save into an emergency fund. If fears of a recession are valid, you’ll want a bigger emergency fund if you face a downturn.

5. Leverage Automated Investments

If you happen to make contributions into the market manually, now is a good time to turn those into automated contributions. If you have to do it manually, there’s a non-zero percent chance you don’t make a contribution. This is especially true in a volatile market, as you may be tempted to wait.

If you automate it, the computers won’t wait. They have no emotions.

6. Work with a Partner

In times like these, financial advisors and planners will tell you their most significant benefit to clients is to be a calming voice or an intermediary to help avoid drastic decisions. You don’t need to work with a financial advisor or planner to get this; just speaking with someone you trust is valuable.

Having an accountability partner whom you believe can remain calm in these uncalm moments is invaluable. If you have one, seek them out and talk through your feelings. If you don’t, look for one.

7. Put it in Perspective

Remaining calm in a volatile market is one of the greatest skills, but there’s always the nagging feeling that perhaps this time it’s different.

Markets have endured tremendous shocks. We most recently had a worldwide pandemic that forced governments to shut down our society, and we recovered within a few years. We had the Great Recession just before that, precipitated by a massive fall in the housing market, the failure of several storied financial institutions, and pushed the government to step in and provide trillions in support to prevent systemic failure. And we recovered.

This has all happened before and will happen again, remain calm and invest on.

Other Posts You May Enjoy:

10 Ways to Protect Yourself Against a Recession

In early April, Goldman Sachs raised its forecast of a U.S. recession in the next 12 months to 45%. J.P.…

OnePay: New Account $125 Bonus

OnePay has a cash bonus offer when you open an account through Rakuten and make a direct deposit. See the terms of this offer and how it compares with others.

Best Free Online Streaming Services for 2025

If you’ve already cut your cable, congratulations on taking advantage of big savings provided by free streaming services! If you…

5 Best Robinhood Brokerage App Alternatives

If you’re looking for an alternative brokerage to Robinhood, we put together a list of brokers that offer free trades, no minimums, no account fees, and (preferably) a new account bonus.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.